The Definitive Guide for Wealth Management

Wiki Article

Everything about Wealth Management

Table of ContentsThe 4-Minute Rule for Wealth ManagementThe 4-Minute Rule for Wealth ManagementHow Wealth Management can Save You Time, Stress, and Money.Examine This Report on Wealth ManagementGetting The Wealth Management To WorkSome Ideas on Wealth Management You Need To Know

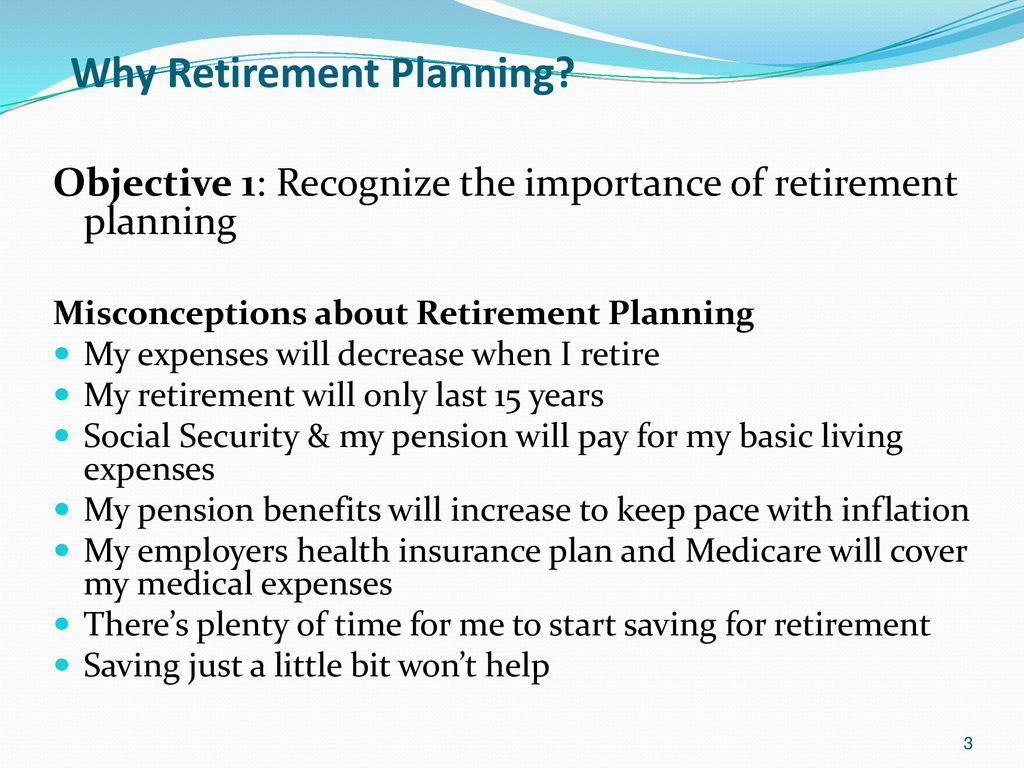

However, numerous do not have access to an employer-sponsored retirement, such as a 401( k) strategy. Also if your company does not supply a retired life plan, you can still save for retirement, by placing cash in an Individual Retirement Account (IRA). Remember that slow-moving and also consistent wins this race.While your retired life may seem a long way off, you owe it to yourself to look toward the future as well as start assuming about what you can do today to help guarantee a secure retirement tomorrow. Although time may be on your side, if you ask some of the senior citizens you know, they will probably tell you that saving for retired life is not as simple as it initially shows up.

But, lots of people do not realize the potentially major effects of rising cost of living. At 3% inflation, $100 today will deserve only $67. 30 in 20 yearsa loss of one-third of its value. At 35 years, this amount would certainly be additional lowered to simply $34. 44. Hence, it is vital to look for retired life savings lorries that have the ideal possibility of outpacing inflation.

Wealth Management - An Overview

The sooner you acknowledge the results that economic pressures can carry your retirement income, the more probable you will be to embrace methods that can aid you accomplish your long-lasting goals - wealth management. Being proactive today can help raise your retirement savings for tomorrow.If preparing for retired life appears like it may be boring or tough, assume again It's your possibility to consider your objectives for the future and shape a new life survived on your terms. Taking a little of time today to think of your life in the future can make all the difference to your retired life.

A retirement strategy assists you obtain clear on your objectives for the future, such as just how you will spend your time, where will certainly you live as well as whether your partner feels the same. Recognizing when you intend to retire makes it much easier to prepare.

Wealth Management - Truths

A retirement financial savings strategy that considers your income, extremely balance, budget plan and also staying functioning years can offer the increase your super requirements. Senior citizens and also pre-retirees deal with some one-of-a-kind risks when it pertains to their financial investments. A retirement can help you take care of key threats and also guarantee your investments adjust to fit your phase of life.

A retired life strategy will certainly explore your options including incomes from part-time job, financial investment revenue, the Age Pension and also incredibly cost savings. Dealing with a seasoned retirement planner can assist provide monetary security and comfort. It can give you confidence that you're on track to be able to do things you desire in retired life.

Right here's why you should start preparing early as opposed to when it's far too late. Website Retirement takes you to a brand-new stage of your life wherein you can really make time for on your own as well as delight in tasks that you have actually not had the ability to take note of during your job life.

The 8-Second Trick For Wealth Management

Spending in a retirement strategy is necessary to guarantee this same criterion of living post-retirement. That will aid you with a consistent income every month even after retiring.

This means that a person will certainly have to pay even more for all costs in the future. Therefore, while carrying out essential retirement preparation, you can consider this factor and also you can find out more generate an enough retirement fund for your future to live a tranquil life. After your retired life, you should not depend on any person, especially your loved ones.

Wealth Management for Beginners

Yet, with all these advantages and also more, you can not refute the fact that this is undoubtedly a great investment chance to quit on. That's best start today!. Since you have understood the value of retired life preparation, you can start by improving your wise retirement today.

Preparation for retired life is a method to help you maintain the exact same high quality of life in the future. You may not desire to function forever, or be able to completely depend on Social Protection. By submitting early, you'll give up a portion of your advantages.

And also your benefit will actually enhance if you can postpone it further, up till age 70. (since they desire or have to), and many retire later (once more, because they want or have to) - wealth management.

When should click for more you begin retired life preparation? Even if you haven't so much as thought about retired life, every dollar you can save now will certainly be much appreciated later.

Report this wiki page